In the past, when I managed a company that manufactured and supplied office furniture to institutions, I began my term by visiting the delivery area to find out how deliveries are handled.

To my surprise, I discovered that there was no follow up on packing lists and that the drivers didn't always turn them in.

The issuing of invoices and packing lists was manual and follow-up on these manual invoice books was possible, albeit a little awkward, but in any case, was not undertaken.

Without packing lists signed by the customer, one cannot collect payment from the customer. There is no evidence that the customer indeed received the goods, or whether the driver chose to deliver them somewhere else. The issue can be particularly problematic at companies with numerous branches, such as banks.

Delivery is made to one of the branches and payment is undertaken by a system located at the head office. Without full documentation (signed order, signed invoice and packing list), we have no chance of collecting payment.

We began to gather information on all the packing lists from the last month that had not been turned in. We checked with the drivers and managed to collect packing lists at a value of NIS 80,000. Not a bad harvest. Just think of how much money we lost from lack of attention to this before.

Since that incident, the issuing of shipments is one of the weak points I look into at every company I work with.

One of my testing methods is to write down details, together with the employees involved, and draw a flow chart from receipt of order, through to issuing of shipment and up to collection of payment. With the assistance of this flow chart and by asking the right questions, we can locate any weak points.

Weak point one: No follow-up on packing lists

The first weak point occurs when there is no thorough follow-up on receipt of returned delivery invoices and packing lists signed by the customer. Here the natural question is: "Is there follow-up on receipt of signed packing lists? What does it consist of?" The answer is usually that there is follow-up and that all packing lists come back when signed.

Managers apparently think all is fine, because if they thought otherwise, they would probably make some changes.

Employees will rush to say that there is no room for errors. It's an almost instinctive reply, but mostly to defend themselves from guilt that hasn't even been leveled at them. Except that reality might be completely different.

In order to identify potential failures in this stage, we must accompany the process with an in-depth investigation. And each time we spot an error, we must investigate it thoroughly and verify the root cause for it.

Weak point two: Different computerized systems for financial and production management

The second weak point occurs when a company works with two information systems. With one system (e.g. SAP or Priority), the company manages the entire financial and accounting system, including receipt of orders and issuing of invoices and packing lists.

With the second information system (sometimes a system constructed for the company), they manage the production system.

The transfer from the system that receives orders (e.g. SAP) to the system that manages production almost always takes place through a manual command of "copy paste". There may be situations where the customer has ordered a particular product and during production the customer changes the order – in most cases, increasing order quantities.

When the order is ready and shipped to the customer, we don't always remember to update the accounting management system, and then the customer pays according to the original order and not according to what is actually produced.

If the customers have reduced order quantities, they will be very alert and won't pay according to the original invoice. But if they have increased quantities and the invoice sum still reflects the original order, many customers won't report it.

Weak point three: Manual packing lists

Even companies with organized information systems sometimes continue to issue manual packing lists. If you ask why, you may get all types of answers. Sometimes it's an old rule that has survived until now, sometimes it is convenient for someone, whatever their reasons, for there to be a bit of confusion, or perhaps follow-up on some shipments isn't organized.

Outstanding payments

Up to now, I have addressed product that is shipped and for which the company has not charged. This must seem crazy and impossible to you, but it is a description of a reality that exists at many companies. There is another source of money loss: the shipment process is fine, but the company issues invoices and does not collect payment.

For various reasons, there may not be regular, organized follow-up on payment collection.

In this case as well, when I work with a company and ask management what the payment collection situation is, they are usually sure everything is fine. But when we generate a debt-aging report and examine the oldest debts, a different reality emerges of old debts that have not been collected, or lost debts.

The managers and accountants usually know about the lost debts, but do not take care of them. At least if they cancelled the charges, they might get their VAT back.

The aging of debts and follow-up on payment collection is one of the most neglected issues I have encountered.

It is strange, of course – you have manufactured product, you've delivered it and the customer has received it, but for some reason has not paid, and here the handling stops. Why is this?

Perhaps the customer is not paying because he can't, perhaps he has gone bankrupt or closed. Sometimes nonpayment may be due to claims regarding the product supplied, or because you have not completed the project. Small debts are still open and the customer delays payment on tens or even thousands of shekels.

The more you postpone handling your debt collections, the smaller your chances will become of obtaining even partial payments.

Why don't we address our debt collection?

This is a good question, with no truly good answer. But the fact is that it's a common reality. One possible explanation is that it isn't pleasant for us to handle debt collection. Another explanation may be linked to the complexity of coping with a customer who won't pay.

More than once, when a customer has claims, it takes the cooperation of several elements in the company to address it: production manager, salesperson working with the client, accountants and sometimes even the CEO. There is no one to coordinate this discussion, and therefore the demand for payment is not handled and often forgotten.

But time goes on, and a customer who hasn't paid today may not pay tomorrow either. If the outstanding payment is due to paperwork issues, after a few months or years, it will be virtually impossible to amend, and you will have to accept another debt that cannot be collected.

A potential example that I mentioned at the beginning of this article: you have sold product to the branch of a company and the paperwork was inaccurate. Head office doesn't recognize the order, and if you don't take care of this asap, there might not be any chance in future of tracing whoever ordered or received the goods.

Execution invoices

Companies that execute projects or integrate with other projects face an additional difficulty. The customer invoice must pass through the customer's project manager (more than once an external company, a third party) and it takes a long time until you see payment. And in the meantime, you have to pay VAT.

Some companies issue an execution invoice, and only when the customer pays do they issue a tax invoice. Here there is a new obstacle: the execution invoices are not listed in the financial system and won't appear in the aging debt reports. Follow-up on them is complicated and often avoided, and the result, of course, is that the payment is not collected.

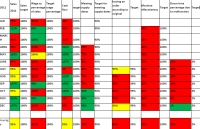

Measures

As with every issue, to continue to improve in payment collection, you have to measure the extent or scope of late payments. Have a weekly discussion, select the principal debts that need addressing (the latest or largest debts, or combinations of this). Allocate tasks with someone responsible for execution and time schedules.

In the next meeting, go over the tasks that were to be completed.

Summary and Recommendations

This article addressed all the stages that occur following production and shipment, particularly for companies that manufacture for other companies (B2B).

We have already covered most of the expenses linked to product manufacture. The product moves from the production process to handling by a number of systems: logistics, sales, accounting, etc.

In this connection or seam between various systems in the company and between them and the customer, there are a number of weak points that may prevent you from collecting payments you are owed.

These weak points are hidden from view. The fact that they cross several managers within the company and the fact that the managers feel sure that everything is fine make it very difficult to address the problems I have mentioned here.

I recommend that you appoint someone in the company to be in charge and to follow up on everything that happens from shipment of goods to receipt of payment for them.

My First Book: Manage! Best Value Practices for Effective Management

My First Book: Manage! Best Value Practices for Effective Management