"Ministry of Commerce: 20% of Israelis Pay 85% of our Revenue Tax" (article in The Marker, February 8, 2017).

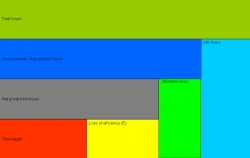

This distribution illustrates the principle known as the Pareto Principle, or the 80-20 rule.

This principle was developed by Italian economist Vilfredo Pareto (1848-1923), who claimed that in many situations, 80% of the results or effects stem from 20% of the active factors or causes. Pareto found that during his time, 80% of the wealth in Italy was in the hands of 20% of Italians.

This principle indeed exists in many situations, including the example I have developed for this article, even if the percentages aren’t exactly 80-20.

How does it help us?

If we address the 20% of principal products manufactured (see example later on), we can attain a significant improvement in results (eg. profits). In this way, we can concentrate our efforts and resources and be decisive and efficient.

Let's assume that we wish to improve company profits and in this regard, we are examining product pricing. If we sell 100 different types of products and arrange them in a table in descending order (from the product that generates the highest profit to the product generating the lowest profit), we will probably discover that the first 20 products on the list generate approximately 80% of the profits.

Therefore, if we research the pricing on these 20 products (i.e. we examine the costs for production of each product and how much profit remains from our sales price), we can act to improve the profitability of each product, or we may decide to stop selling it, and we can attain a swift improvement in company profits.

Let's look at an example:

Let's assume we own a company with a factory for men's shoes where the annual sales turnover is NIS 10 million. The company isn't making a profit, but isn't showing losses.

Brown shoes are the product most sold, and they generate 40% of revenue, which is NIS 4 million annually. This product's bottom line is that it isn't losing but it isn't making a profit.

Red shoes are the product that sells the least, generating 0.5% of revenue, which is NIS 50,000 annually.

Pricing research reveals that red shoes are sold at a price lower than production cost, resulting in a loss of 10% of the sales value, which is NIS 5,000.

We have a product (brown shoes) that isn't losing or making a profit and another product (red shoes) that loses 10% of its sales value.

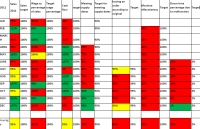

Now let's organize all this data into a table:

| Product | Annual sales turnover in NIS thousands | Rate of total company turnover | Profit or loss in % from total product sales | Profit or loss in NIS thousands |

| Total sales | 10,000 | 100% | 0% | 0 |

| Men's shoes brown | 4,000 | 40% | 0% | 0 |

| Men's shoes red | 50 | 0.5% | -10% | -5 |

Note: The company has other products as well. The total profit does not include only the sums of the two products listed above.

Company management decided to execute a makeover, recruiting their workers and the help of an internal improvement team to improve company profitability.

Due to various restraints, management then decided that there would only be two improvement teams.

Team A addressed the profitability of brown shoes and obtained an improvement in the product's annual revenue of 5%.

Team B addressed the profitability of red shoes and obtained an improvement in the product's annual revenue of 10%.

Now let's organize this data in another table:

| Product | Annual sales turnover in NIS thousands | Rate of total company turnover | Rate of improvement from product's annual revenue | Profit or loss in % from total product sales | Profit or loss in NIS thousands |

| Total sales | 10,000 | 100% | 2.05% | 205 | |

| Men's shoes brown | 4,000 | 40% | 5% | 5% | 200 |

| Men's shoes red | 50 | 0.5% | 10% | 0% | 0 |

Note: Among the company's other products there was no change and therefore, everything attained by the two teams reverted into company profit. The red shoes lost at first, and the closing of this product loss increased general revenue.

It is easy to see that although the improvement team addressing red shoe profitability attained an improvement of 10% of annual product revenue and the team addressing brown shoe profitability attained an improvement of only 5% of annual product revenue, the contribution of the improvement in brown shows is significantly greater. We might almost say that the improvement in red shoe profitability is negligible. Therefore, the first team acted correctly when it analyzed and improved brown shoe profitability, and the operation of an improvement team on red shoes was an error in judgement. The second team should have worked on the second product in the Pareto list.

Summary:

The Pareto Principle, or the 80-20 rule points to approximately 20% of active factors determining 80% of the result.

This rule enables us to determine a set of priorities with our reference to the ocean of data available to us and to address the main factors (approximately 20% of all factors), thus significantly affecting the result.

In the example, we saw how the proper allocation of resources (in this case, the allocation of improvement teams) can give us higher value in a shorter time.

My First Book: Manage! Best Value Practices for Effective Management

My First Book: Manage! Best Value Practices for Effective Management