This article references my book Management and Leadership.

Actual Revenue is the Oxygen of any Company. The Transaction Ends Only When You Have Received Payment.

Someone once called me for advice. He told me he was self-employed and asked if I could help him collect money his customers owed him. The amount of the debt was about 1 million NIS. He worked for two years without receiving payment.

He's not alone. The amount of debt clients owed him was exceptional, but many self-employed people or even companies, forget to collect what they deserve.

Some other examples: A close friend who is a singer has performed in several places and sent each an invoice with all the paperwork required to register a supplier, including her bank account details. The terms of payment were a month and a half. She trusted the customers to pay, and forgot to make sure they did.

One month after the original date of payment, she contacted the clients and inquired why the money had not been received. One place wrote that they had lost the invoice and asked her to send a copy. Another month passed and the money did not arrive, so she contacted them again, this time more assertively, and the payment was transferred.

Another client wrote that the payment had been transferred, but a re-examination revealed that it had been transferred - to another singer's account. They apologized and promised that at the next payment date (in a little over a month) she would receive her money. This time my friend wasn't so gentle, and payment was transferred to her the next day (four months after the concert).

The CEO of a small company once asked me if it was okay to call a customer after two months of late payment. My answer was that it would be best to call the day after the payment was due.

I believe everyone understands the damage done to cash flow when a customer does not pay. And yet, in many companies, debt collection is not handled properly.

When Collecting - Be Kind but Assertive

Be kind always, but at the same time be assertive. Don't give up on payments you deserve.

At the end of it, even when dealing with other companies, a deal is made by people on both sides. Whether you are self-employed, company managers, accountants or finance managers – people on the other side are just like you.

You had provided them with a product or service to their satisfaction, and now it's their turn to pay. There's no reason to feel the discomfort that many feel. Nor is there a reason that a demand for timely payment will prevent you from continuing to work with the same client.

This may sound trivial, but even the customer who has to pay you, in turn charges payments from his customers. This is the way of the business world.

Shimon, my yoga teacher, doesn't follow-up. He places a notebook and an envelope near the door, and at the end of the lesson each student puts the payment in the envelope, or pays through one of the apps, and writes their name in the notebook. Those who did not pay this week will repay their debt next week. I've never heard of non-payment. But Shimon is one of a kind. Don't try this, the method does not work in a normal commercial environment.

Keep Track of Payments You Receive

While freelancers can manage monitor payments in a relatively simple way (I'll soon recommend practical solutions), for companies, tracking can be more challenging. The more customers you have, with varied payment terms, the more complex the tracking will be.

Complex, but not impossible. I recommend issuing a debt report from the accounting system every week. Work in a small team of accountants, and check which customers have not transferred a due payment. Now call everyone on the list you made. Many times, you'll receive interesting answers, like "the check was sent by mail" (you should switch to bank transfers), "we can't find the invoice", or "the goods or service we received is not valid".

All of the above require follow-up. At the end of each weekly discussion, write a summary with the required actions, and follow them. Small companies have a smaller team for such a discussion, maybe just one person, but such companies will have fewer customers.

Keep a list of actions and follow-up execution. If the customer claims that the goods he received from you are defective, check this immediately. If necessary, involve the CEO immediately. Don't let debts grow.

How to Measure Yor Collection Activity?

I recommend two success metrics for the collection team's activity:

- Total debts in arrears, starting from the first day of arrears.

- Total debts that are in arrears beyond the current month, in order to differentiate between arrears that do not exceed a few days.

Due to the high importance of debt collection, I recommend that these two metrics be part of the company's monthly dashboard. How you address short-term debts (during the current month) will be different from how you address long-term debts (beyond the current month).

Years ago, I ran a company that carried out many projects, for a significant part of which no payment was received. When I went to look into the matter, I found that the clients who owed us payment had quite a few justified claims. For the most part, a simple action was missing to get the payment. I remember a debt of 300,000 NIS owed to us by one of the largest universities in the country. The inspection revealed that the project was officially completed three months ago, with the customer's comment on a small detail that was missing, and therefore they did not transfer the last payment. Twenty minutes of work made it possible to receive the big paycheck.

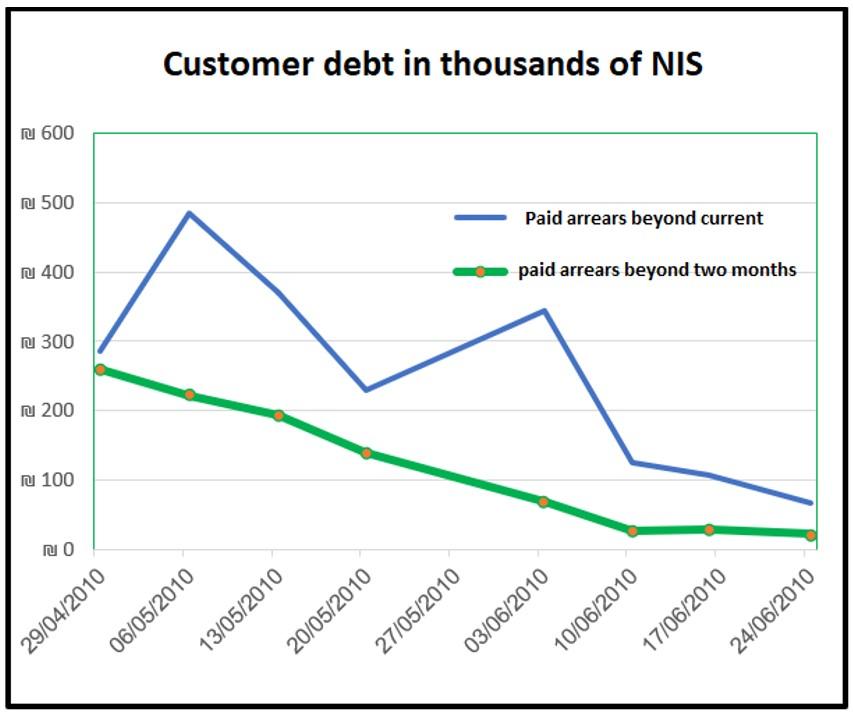

At another company I worked with a few years ago, we identified a significant debt collection problem. The illustration below depicts the rapid success the company had once it decided to tackle the problem: in a short time, it greatly reduced the scope of its customers' debts.

Successfully eliminating large customer debt in a short period of time.

How to Keep Track Within Small Businesses?

For freelancers or small companies, I recommend working with a tool that will make it easier to manage payment dates, like Asana, an app that helps you organize your tasks and reminders for any future receipt, both on computers and smartphones.

I, for example, built an Excel report of expected cash flow for my business, and I check it daily to see if I received the payments that were due.

The Role of Salespeople in The Collection Process

Salespeople are the customers' contacts, and therefore have a substantial part in the collection process, especially when payment is not due.

To keep salespeople committed to the collection process, it's imperative to reward them only through a commission (beyond the base salary required by law), and pay it only for money actually received from the customer, not for an invoice issued to them.

I have encountered problems when operating every other way. Salespeople who are only rewarded with salaries and not commissions very quickly lose the motivation to bring in more sales. And when they receive commissions on invoices and not on payment that has arrived, their commitment to motivate the customer to pay decreases.

How to Treat Customers Who Are Regularly Late Paying, Or Who Do Not Pay at All?

First, do not be afraid to "lose a sale" for those who do not pay. If someone doesn't pay you, there's no reason to provide them with further goods. A sale that doesn't bring payment does not contribute to the company and even causes damage.

But before removing a customer from the list, there are a few more things you can try:

- For customers who are regularly late but do pay, try to build conditional payment terms. A slightly higher price with discounts for timely payment (i.e. return to original price), or larger discounts for early payment. In any case, keep your finger on the pulse and monitor their payments more closely.

- In extreme cases, make sure you get prepayment.

- Demand to receive a check against the delivery of goods.

- When there is an unpaid debt, make sure the customer does not receive goods as long as they haven't paid. Not infrequently, companies that have not paid, urgently need a broken part replaced or a similar item. This is the moment to collect their full debt to you.

- The goal is to continue working with the client and maintain a good relationship. But if they don't pay and all inquiries to them do not help, start a collection procedure: a formal letter from the CEO, followed by a letter from an attorney, then a notice before going to court, and finally filing a lawsuit. It doesn't happen often, but sometimes there is no choice. If the debt is small - apply to the Small Claims Court. The filing of a lawsuit often promotes a compromise.

Summary and Recommendation

- The money customers pay is a company's oxygen. For the most part, the company has already spent money on producing the sale, so collecting payments is critical to its existence.

- Don't be ashamed to request payment on time. Those who pay you, in turn, make sure to get what they deserve on time as well.

- If the payment did not arrive, kindly but assertively call the next day and check what happened.

- For the self-employed or small companies, I recommend using the various tools available on the internet, such as the Asana app, or keeping track of the expected cash flow using Excel.

- For companies, I recommend issuing a debt report every week, holding a discussion with a small team and handing out personal tasks for contacting and tracking all late customers for a fee.

- If a customer is regularly in arrears, work with advances or take other steps, as I detailed above.

- Make sure the collection indices are included in the company's monthly dashboard.

- Reward salespeople only through a commission, and see that this will only be paid upon receipt of payment for the sale they've made.

- The norm is that there are no debts in arrears. If there are any, they must be addressed and collected. If there are many debts, start tackling the big ones with official actions, and set goals for the collection process.

- Proper handling of the first debt conveys an important message to the customer, reducing the risk that they will defer payment in future transactions.

My First Book: Manage! Best Value Practices for Effective Management

My First Book: Manage! Best Value Practices for Effective Management