The company Ei'lam manages has several fields of operation, one of which is importing and distributing technological equipment. This is a commercial activity, and is showing a consistent loss, but despite this, is very close to Ei'lam's heart.

Ei'lam and I analyzed the company's operations, and for all other fields managed to create a profit generating work-plan with reasonable effort. Contrastingly, it seemed impossible to create such a work-plan for the import and distribution side of the business.

I asked Ei'lam the key question: "if you weren't already in this business, would you enter it now?"

After some thought, Ei'lam answered he would not.

"So what are you going to do about it?"

Ei'lam took his time answering, and after thinking for a while said – this side of the business should be shut down.

I learned these two questions from The Definitive Drucker.

Feelings Affect Our Business Decisions

You're probably familiar with the situation: feelings are often involved in business decisions and affect them.

In the end, Ei'lam created a work-plan that could (theoretically) generate profit for the import and distribution business. A small profit, but a profit nonetheless.

To achieve that, a few challenging steps had to be taken.

I told Ei'lam I'll help him, but asked that first we examine possible outcomes within several scenarios.

Every plan we create is influenced by our thoughts and hopes. It doesn't matter how "objective" we try to be, our assumptions are influenced by our feelings on the issue. Every business plan reflects the assumptions at its base. And even when the base is shaky, soon you forget the assumptions on which it's built and treat the plan as neutral.

Before I discuss a way to examine outcomes, I want to remind you that some changes and surprises are always "unexpected".

The Corona Crisis – A Black Swan?

For centuries European believed all swans were white. It wasn't until the colonization of Australia that they learnt that swans can be black too. Nassim Nicholas Taleb turned the phrase into a metaphor for meaning a rare and unexpected event with a dramatic effect, after which people scramble to come up with an explanation to make it less random and more predictable.

The financial crisis resulting from the current pandemic is a kind of black swan. Even though, in a "global village" world economy, it was possible to predict that such a pandemic could erupt – and some even warned it was coming – it never occurred to most of us. Policy makers didn’t plan for it, and the crisis caught almost all countries by complete surprise.

Such substantial changes aren’t unheard of, but even a smaller financial crisis can wipe out companies.

So, when making a business plan, it's essential to take into account various scenarios.

The business plan must reflect possible changes, not just one static situation.

The Plan's Sensitivity to Changes in Conditions

Let's go back to Ei'lam's plan: I showed him a model for profit-loss reports over 5 years, where data is connected to two cells. The first allows me to change sales predictions, and the second, to change costs. In the last tab of the excel file I have a chart showing the main financial data over time (sales, gross income, net profit) over the 5 years period.

That way, by changing sales or costs, I can see how profits will be affected.

Next to the chart showing the results, I keep track of projected profits in each scenario.

Since Ei'lam's company isn't a new one, he felt looking at the first six months will be enough. The import and distribution business was not profitable the last few years, and Ei'lam said that if it wouldn’t be possible to generate profits within six months, he'll shut it down.

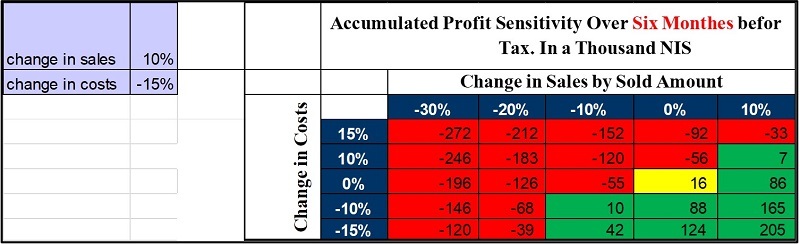

Here is Ei'lam's plan put into the above mentioned model (with a few changes to preserve anonymity):

The Data

The grey cells are the ones in which I inputted changes. In green are scenarios with profit, in red – those with a loss.

The result of the different scenarios shows the risks inherent in the plan. The chance for profit after six months is very low, and necessitates a decrease of 10% to 15% in costs, or an increase of 10% in sales in case of a slight increase in costs.

It became clear to Ei'lam that continuing the import and distribution business will put the owners' money at risk.

A 5-Year Sensitivity Check

Ei'lam only looked at the first six months. On the one hand, he believed that if he'll be able to stabilize operations in six months, it will grow stronger. On the other hand, he was worried that the owners won't continue to fund the commercial activity if it will show a loss after six months.

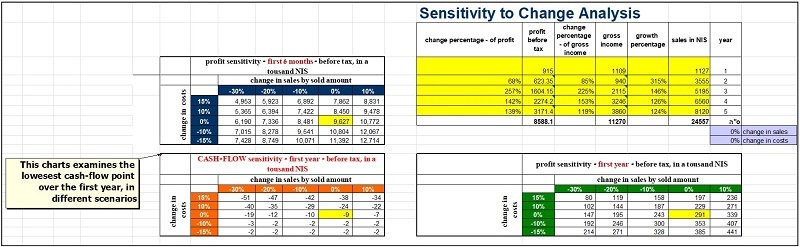

Usually, I look at the first year (which is the most critical) in a month-by-month resolution, and for the next four years in a year-by-year resolution.

Additionally, I look at cash-flow over the first year – which is the investment year. In some cases, chances for a loss are marginal (like in the following example), but cash flow is negative, and the owners can't or won't get the needed investment.

Let's look at the following example, of a different company. In this example, the profit is "immune" to changes. But the first year cash-flow stays negative no matter the scenario. For some, the numbers are very high. This entrepreneur was unable to get a sufficient investment, and he decided not to pursue this project.

Summary and Recommendation

Some companies have products suitable for times of pandemic, and they're doing well right now. Other companies are managing to survive and operate on a smaller scale. Many businesses have closed their doors – especially in retail and entertainment (shopping malls, restaurants, cinemas, etc.).

For all businesses, those still working and those closed, this is an opportunity to plan and think. When you start a new business, or develop a new product, you should begin with a Lean Canvas process. Only if the conclusion is that the business or product is viable, do we then create a work-plan.

In the current situation, while you examine possible futures for your business (as Ei'lam did), you can skip the Lean Canvass process. But under no account should you forego the sensitivity analysis as shown above.

Focused and Fast Coaching and Consulting Services for CEOs and Companies during the Coronavirus Crisis

The Business Excellence team can help you build, within 2-4 working days, a plan to survive this financial crisis, or to achieve your goals.

We can help you to do the following:

Build a plan to handle this crisis, and couch you through it.

Identify possible threats to your company and come up with a plan to approach them.

Implement and manage work-from-home practices.

Identify and maximize the opportunities (!) presented by the crisis.

Our experts have a wide and diverse experience of over 100 years combined managing companies and consulting to CEOs – so we will be able to identify the unique needs of each companies, and find the safest and fastest way for you to approach the new challenges presented by the crisis, and to ensure your company's resilience.

If you are interested in my professional help, personally or for your company, the best way to contact me is to send a request through the Get in Touch form here.

My First Book: Manage! Best Value Practices for Effective Management

My First Book: Manage! Best Value Practices for Effective Management